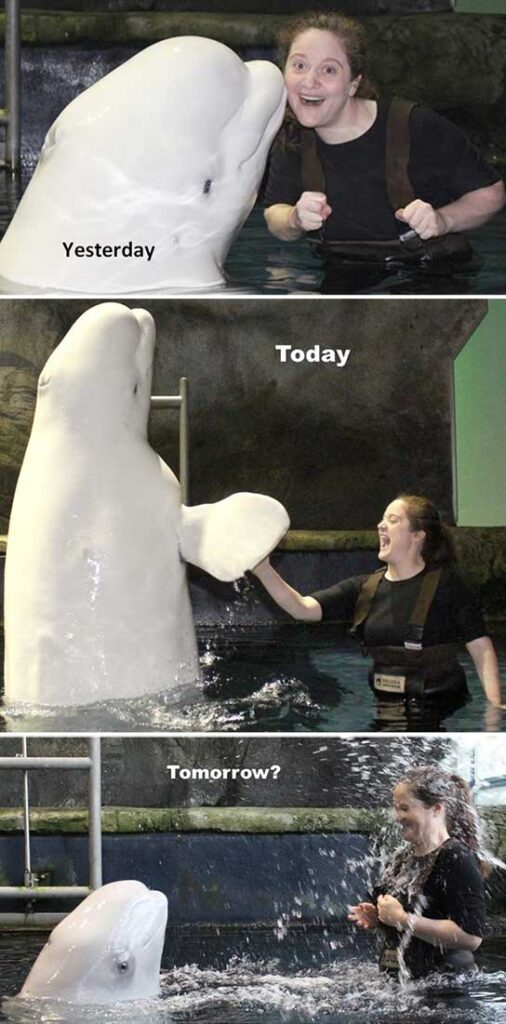

Imagine the State of Illinois as a white, blubbery beluga whale. Let’s examine your relationship with the big beluga as it was yesterday, as it is today, and as it may be tomorrow.

Yesterday, say 20 years ago, you enjoyed a fine time with the beluga. Income tax rates, property taxes, estate taxes, and even the crime and grime were tolerable. You peacefully coexisted, hugged it out, and got along like Raffi singing about baby belugas.

Today, property taxes have multiplied, income taxes have about doubled, and Illinois has imposed its own state estate tax. The Illinois state estate tax is in addition to the federal estate tax. The current Illinois tax hits residents with assets over $4 million, which is reduced by lifetime taxable gifts. The effective marginal state estate tax rate is 28.2% for estates that just exceed the taxable limit. For the largest Illinois estates, the tax is effectively about 9%. Former Illinoisans, like those now living in Florida, are stunned to learn that their Illinois assets may be exposed to the tax – even if their Illinois assets are worth less than $4 million.

Tomorrow? It could be a real whopper. The big beluga has more in mind for its taxing relationship with you. Like a frigid blast of salty fish water to the face, the beluga anticipates as much as a 100% income tax increase, or more, for the most successful residents of Illinois. To add injury to the insult, Illinois has a stealthy and potentially more expensive law swimming below the surface.

Specifically, if a resident of Illinois creates a trust for that resident’s child, in certain common circumstances, the trust will be treated as a resident of Illinois for as long as the trust exists. So, if the child lives in an income tax free state like Texas, the child’s trust will still need to pay income taxes to Illinois for as long as the trust exists. If, in the future, Illinois taxes income at 8%, 10%, or more, creating trusts in Illinois for a child living elsewhere may become especially costly. That is one pricey blowhole to the trust!

It also helps explain why so many people say goodbye to the Illinois beluga and hello to Florida’s manatee.